English III

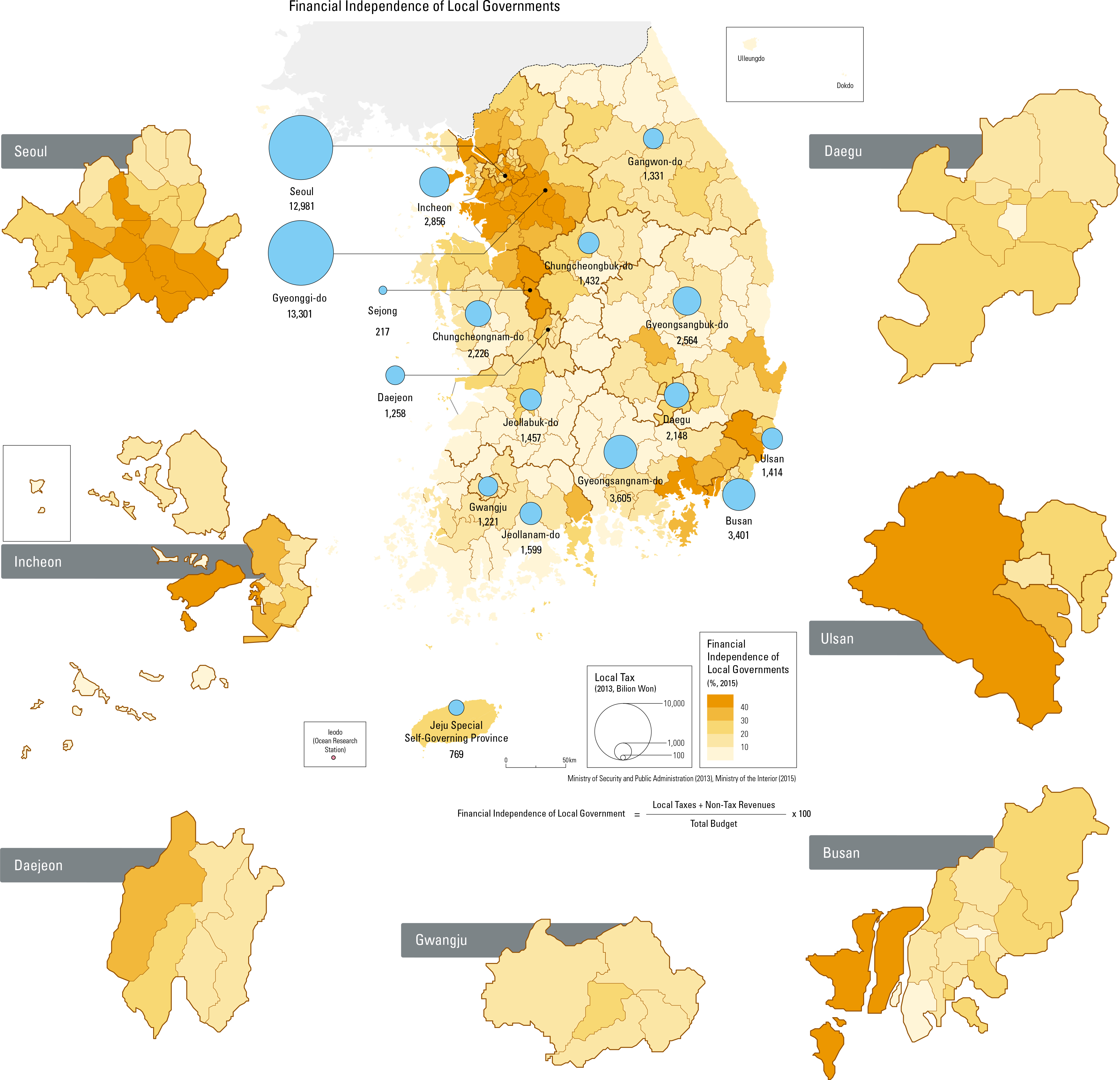

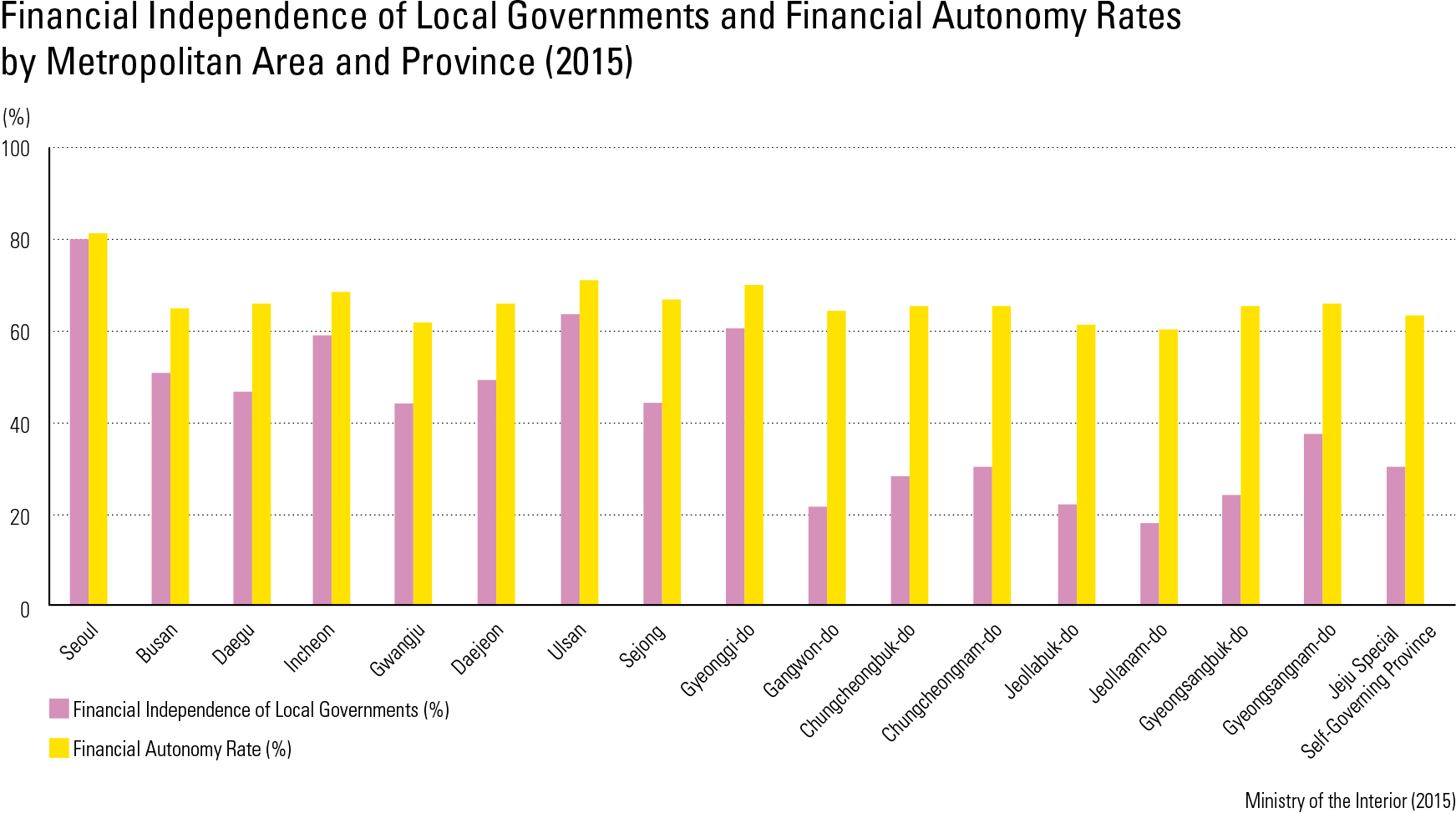

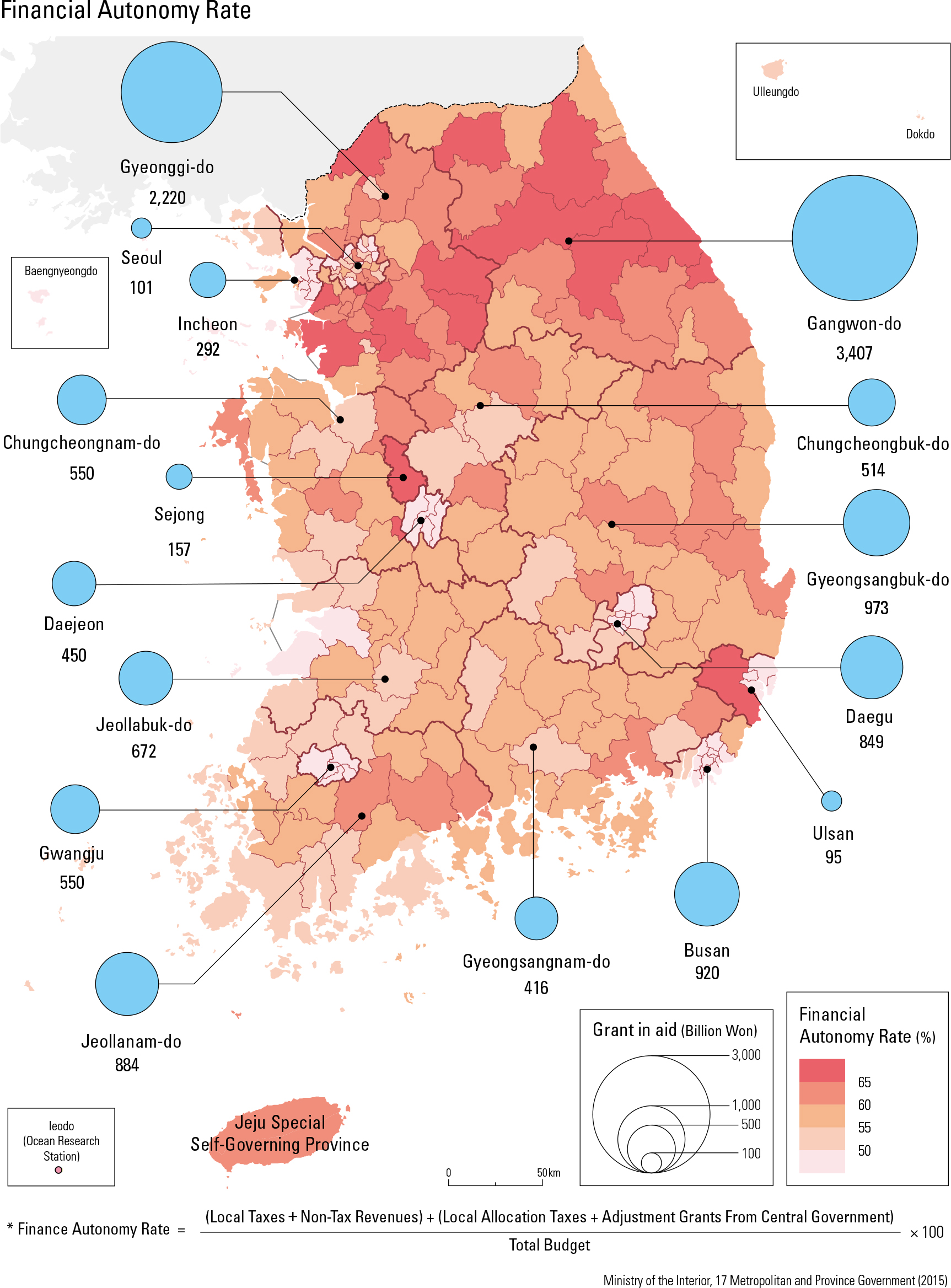

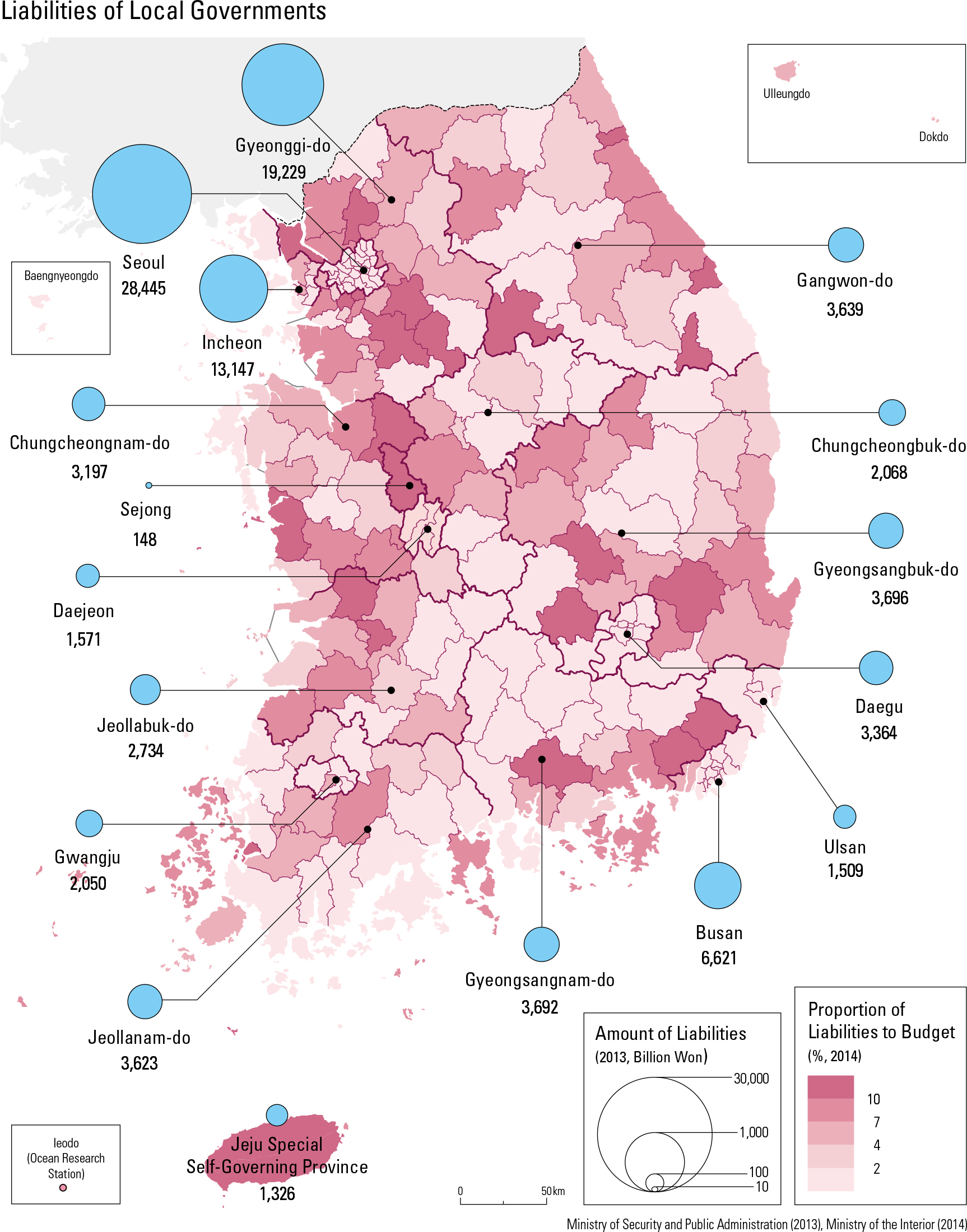

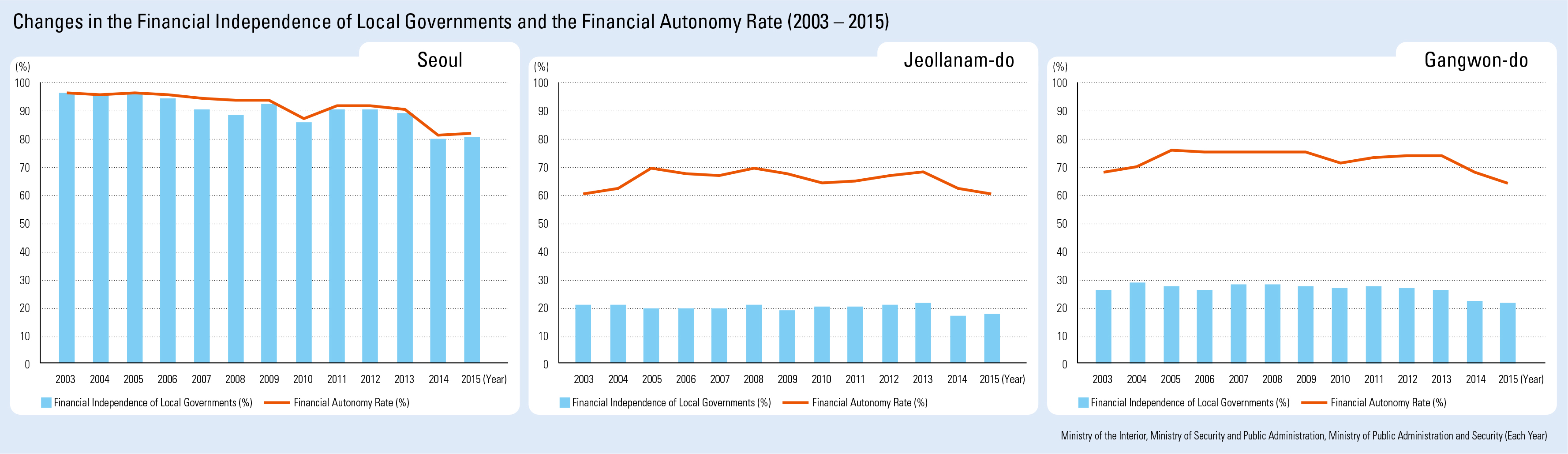

Financial independence for the local government represents the self-reliance capability of fiscal revenue, measured according to the ratio of local taxes and non-tax revenues to the total budget (general account budget). The fiscal autonomy rate is the ratio of the total revenue from local taxes, non-tax revenues, local allocation tax, and adjustment grants from the central government to the total budget of the local government. Financial independence for the local government focuses on revenues, while the fiscal autonomy rate focuses on the overall financial structure. A higher financial independence indicates a revenue collection base, and a higher fiscal autonomy rate means more revenue is available at the local government’s discretion. In other words, nancial independence is an indicator of independence in revenue supply while the nancial autonomy rate is an index of independence or autonomy in the expenditure of revenue. The financial independence of local governments in Korea was on average 57.4% in 2004 and decreased to 45.1% in 2015, indicating a gradually deepening dependence on the central government. The financial independence by region indicated overall higher financial independence around the metropolitan regions, but the rest of the country (provinces and special self-governing province), at 30.3%, was lower than the national average.

page_2 |